Backwardation

It's a 2025 thing

In this report: C.O.T breakdown. Spreads for the win!

Articles

Ukrainian attack damaged 10% of Russia's strategic bombers, Germany says

Alberta Wildfires Shut About 7% of Canada’s Oil Production

Saudi Arabia Wants More Super-Size OPEC+ Hikes

Oil Traders Flock to Niche Options Market to Bet on Glut

Trump says Iran "slow-walking" after negative response to U.S. nuclear deal offer

View

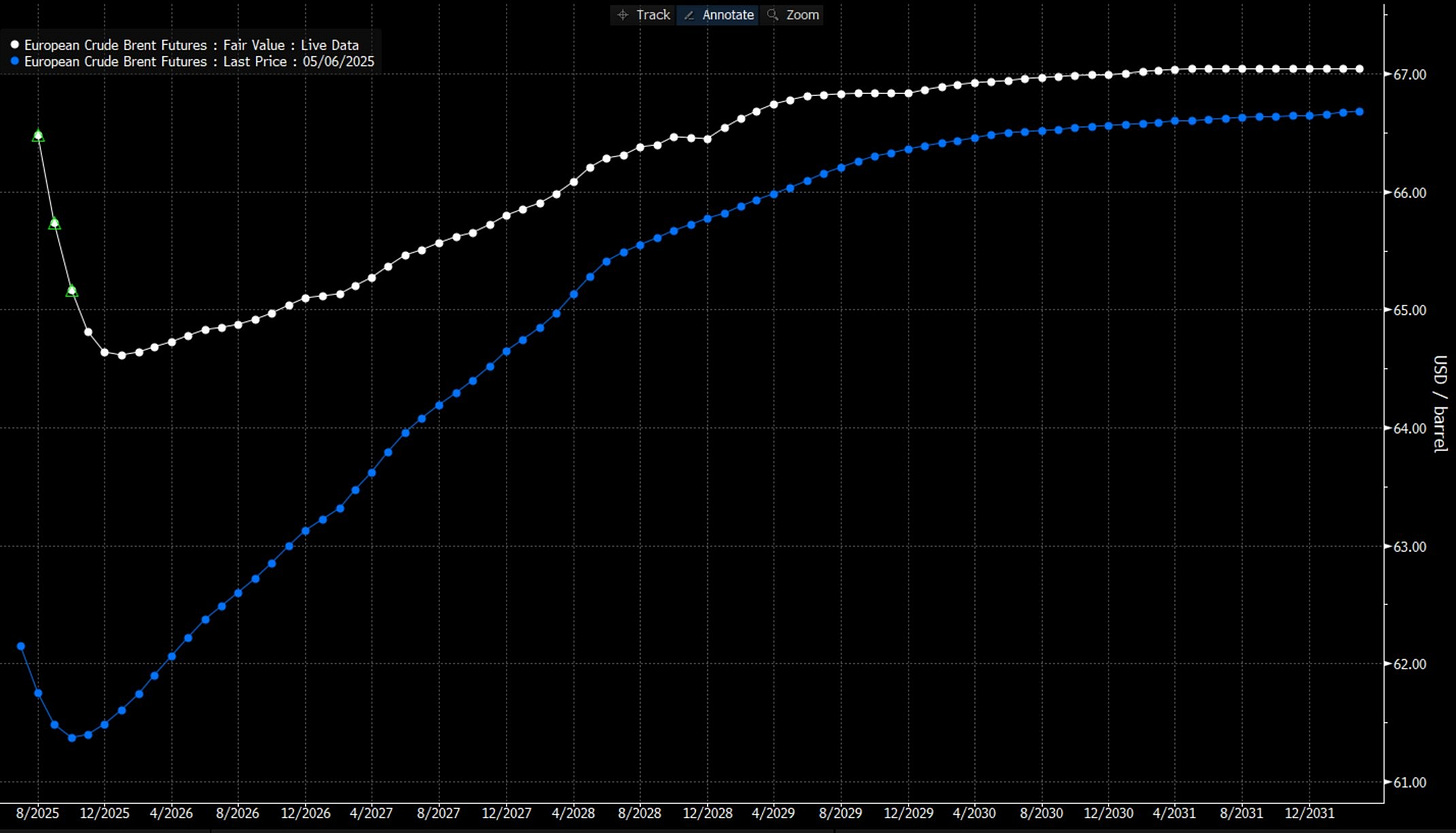

It is not only my view, but the reality, that the oil market at this early stage is into backwardation through 2025 (near prices higher than later prices. Inferring immediate demand is higher). As discussed last week, we have a distinct contango in 2026 (near prices lower than later prices-inferring no immediate demand)

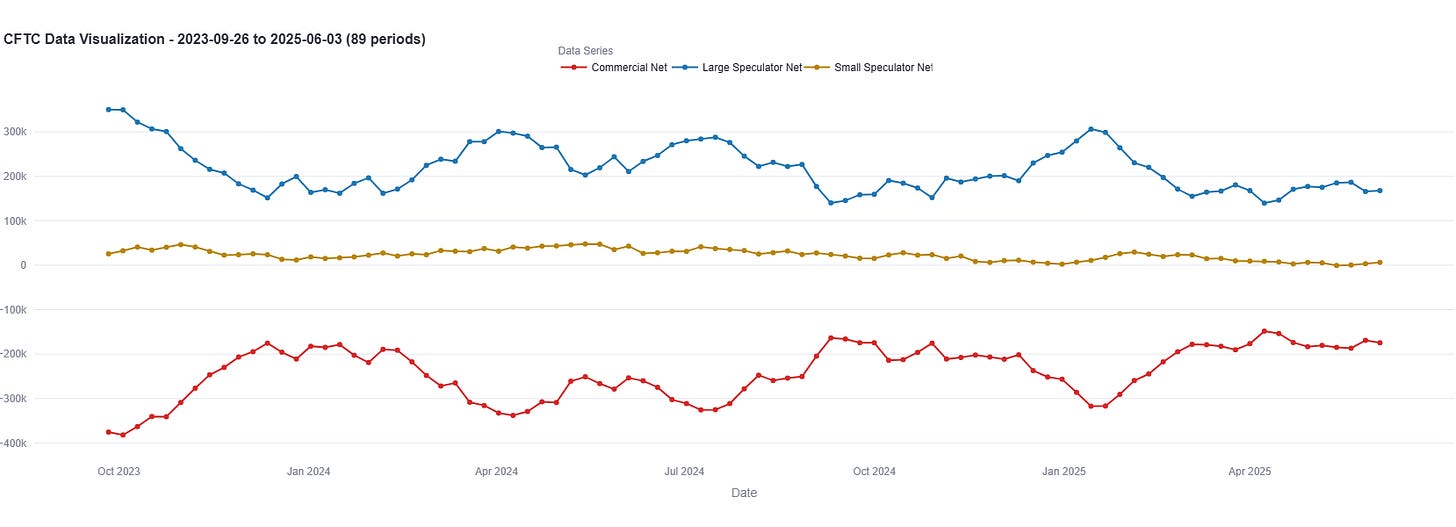

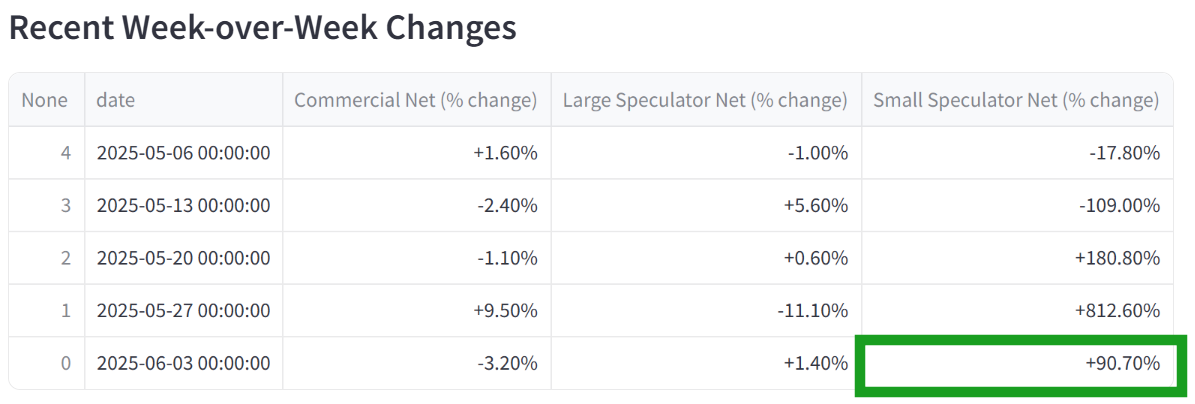

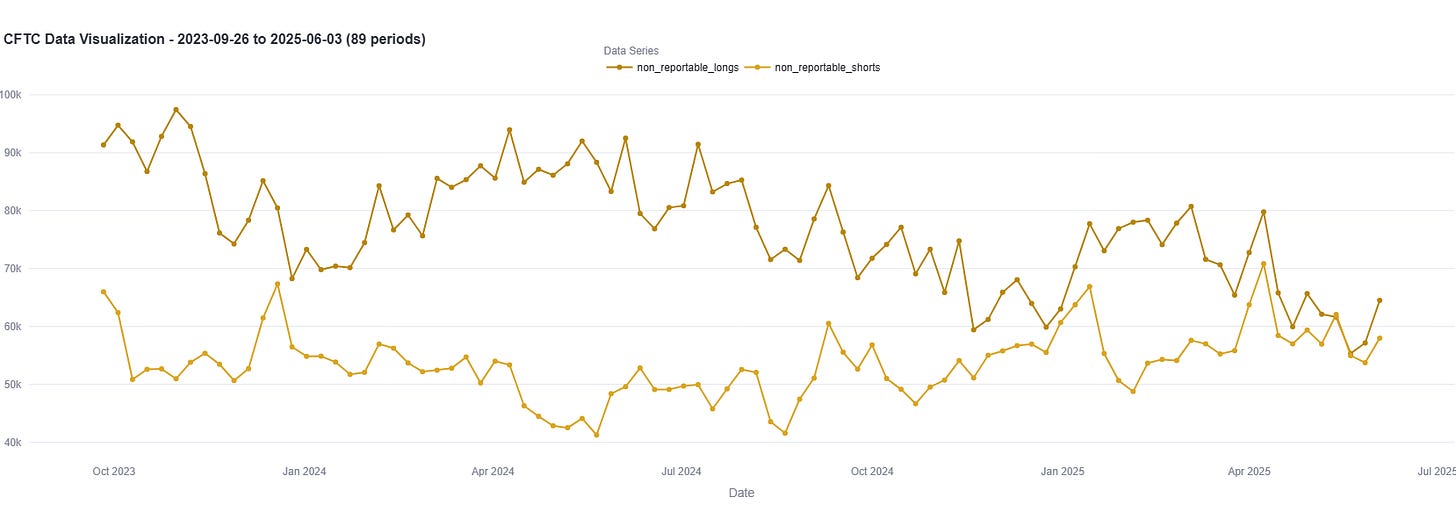

So why is this? The level of uncertainty over trade war tariffs is so high that the global energy complex has decided to price out an uncertain 2025 outlook and look into next year for stability. Let the Trump dust settle. This puts trade volumes for the rest of the year (and as has been so far) as very low in nominal terms. From a traders’ perspective, it means if you are not too familiar with how to hedge against this uncertainty, you will stay out of the market. This is something we have seen so far this year on the C.O.T reports from the small spec side. Below, we can see they are coming back just a little to market.

It is my view that we go lower. Despite me looking for downside off the open last week, the market rallied off the back of Ukrainian drone strikes and Canadian wildfires that occurred after my posting. The structure of the market remains weak, with littleto no justification for WTI above $65. I don’t feel so bad getting last week wrong for 2 reasons.

1: The best oil analyst in the market, Paul Sankey, was also looking for much lower oil coming into last week. However, like me, he was quoting on Monday that the Ukrainian drone attacks and fires in Canada were enough to negate the OPEC+ Production 411kbpd production increase.

The Iranian talks situation is turning sour. Talks are not progressing- see Articles above.

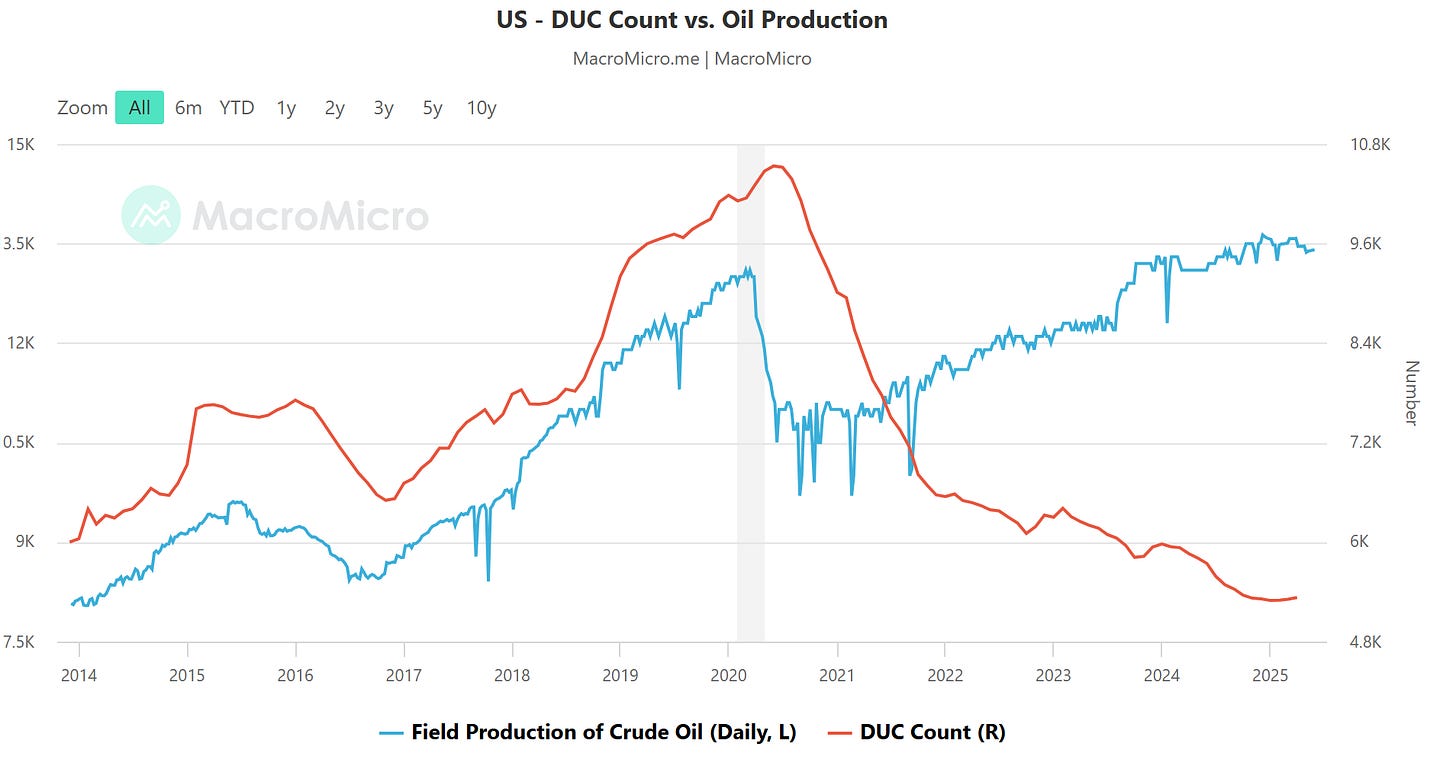

There is a lot of noise about declining rig counts in the U.S., however this is not the bullish factor you might think it is. As previously flagged in ‘Cap Ex baby, Cap Ex’. Do not fall for this false flag op! They can work down the D.U.C.s for another while on little capex.

In short, don’t believe the bull or bear hype. We are at the top of a range. But I’m near-term bearish. I think the highs of last week can not be sustained. Let’s see.

C.O.T WTI

All charts below are generated from proprietary Duggan Capital software tools based on C.F.T.C data.

Small specs

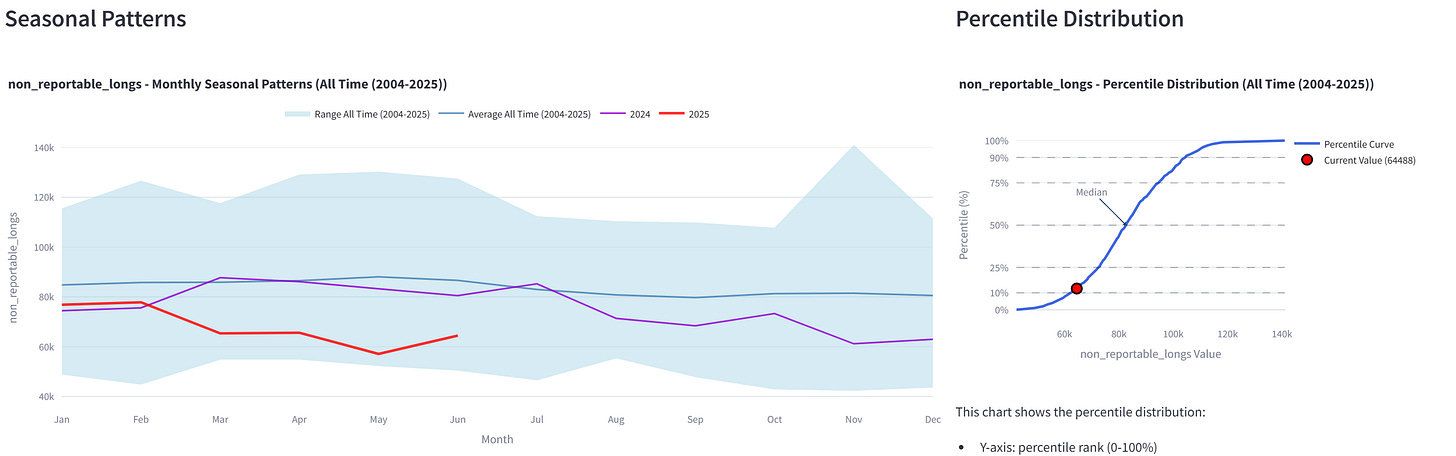

A nice relative WOW increase of 90.7% however the small specs are coming off of a very low base of involvement.

Seasonally, smalls are under positioned for this time of year, however they are net long.