We look at the dynamics surrounding this Saudi extension to cuts/ new plan on reintroduction of 2 million barrels onto the market. Skip to the very bottom for the pure trade setups. If you are a free subscriber, you can use a -free one time-credit to view this comprehensive report.

We have white smoke from the OPEC+ Dec 5th meeting. However the plan is thin gruel for the bulls. The group decided to push back the reintroduction of supply, with monthly increases of 138,000 starting in April through to the end of 2026. This essentially dilutes the prior plan for cuts to unwind through to end of 2025 at a rate of 180,000 bpd.

The market earlier last week had a $2 rally. This was the pricing in of a change of some shape to come. What exactly is difficult to judge. However this got priced back out ahead of the meeting on Thursday. Oil sold down on Friday as the details circulated. Buy the rumour, sell the fact!

The most bullish thing about the OPEC+ news was that there is a hard delay to output rise until April. This may be what the $2 rally was. The reduction of net 47,000 bpd over 2025 and 2026 is meaningful. Does the market think so too? Price says no, so whats next?

The fundamentals are unavoidably weak.

China demand concerns

Trumps re-election call to the enrgy markets is drill baby drill i.e boosting output from The US- read below for details

Looming reintroduction of supply from OPEC+ starting Q2 2025. 2million barrels over 2 years will be hardly noticed. If we get 2 of the usual market shocks, this will overshadow the 2mil.

What is bullish about the overall 24 months picture?

Oil companies are now conservative. Since the covid experience, they are now focused on capital control and constraint. I am of the mind they will not be convinced to break from their new shareholder promises of sensible capital controls, building cash piles and dividend focus.

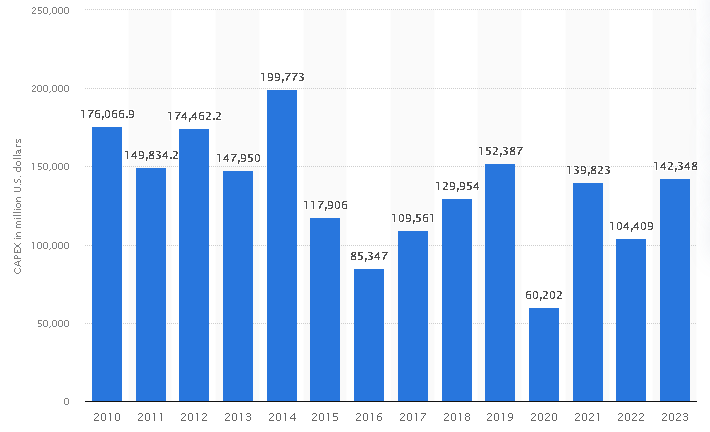

Current Cap ex

From statista we can see global O&G cap ex for 2024 hovering at 2023 levels and below 2019 levels. This speaks to the increased fiscal discipline.

Looking at Trumps ‘Drill baby Drill’ ethos, it will be challenging for him to entice these drillers back out of their current cave of tight spending/ shareholder committed belt tightening.

One thing to consider is the amount of available wells that have been drilled but are uncompleted ie. DUCs. ‘Drilled but uncompleted’ wells. This provides a source of cheap and easy to grab oil in tight times for industry or when they want to tighten belts. We can see in the chart below, the DUC count in North America is low. It says to me that the market will need to petition shareholders somewhat to release some cash and get the inventory of DUCs back up. The main thing that would help with that is a high and buoyant oil price. If we start to trade well below $70/$65 on WTI, this will not be an easy sell to reinvest.

Here is the CEO of Chevron talking on Blomberg after their recent earnings. Speaking about the Permian basin from 1:45min. The key takeaway is ‘stronger margins’. They don't need to spend much more money as technology is now allowing them to extract more for 50% the cost with free cash flow per barrel rising from $5 in the prior decade to $10 in this decade so far.

The rig count number no longer matters given that oil companies can produce much more with less rigs. This has never been a tradable data source though.

Back to trade for the week. I must remind everyone, these charts exhibit where I want to trade and in what direction. Not how I exactly see price moving for the week. When I see price behaving similar to how I have drawn out on these charts, I am more likely to take the trade identified in these charts.

If we look at the historical patterns, the spot market for WTI will keep selling down until 12th Dec. If this is the case, we will breech last weeks lows and move down to $66s. I am of the mind that we rally off the Sunday open as this trade seems vastly over crowded short.

The 6 month spreads start to attract buyers as of 6th Dec. If we combine the presumed price action, I can easily see a buying rally start this week, forcing heavy shorts to puke out, a following dip should put in a 6 month low for oil. In short, stay limber in the intraday, buy the dip on the medium and long term. By the end of this week, I think the dip will be bought and sellers will be way over crowded.

That's all folks. It's going to be a fun week for oil traders. From my experience, the first move will reverse, so take it handy. The fake out will be obvious, just give the market time. You don't have to jump in because you think you missed a move. Chances are, most people on ‘a move’ will get retested and puked out, then the real move takes place.

Trader training at Duggan Capital.

Alpha Edge VWAP CODE: VRBF24

Alpha Pro Trader CODE: VRBF24

Scalper Pro CODE: VRBF24

Alpha Pro (Flagship course) CODE: VRBF24