Inflation on a stick

Markets wait and see

January Book recommendation

The World for Sale - A great read to give you an idea of the reach and power of commodity trading houses and the actual influence they have. Most of you have probably read this

Articles

Trump has few good options to prevent Iran from building a nuclear bomb

Houthis to restrict attacks in red sea to only Israeli ships

Global Oil Supply & Demand Outlook to 2035- McKinsey

Iran is vulnerable to a Trumpian all-out economic assault

We saw a deep pullback this week gone by, a suitable repricing down while we play ‘wait and see’ on what Trump oil tariffs actually get implemented. 25% tariffs are slated for Canadian and Mexican imports by Feb 1st and potential further sanctions on Iranian oil. The market is waiting for more colour/action on this, with Goldman seeing a 15% risk of actual implimentation. Important to note however that they see a pricing in of 40% already. Personally, I think if it is to be priced in, we move a lot higher and our pullback this week was repositioning from expensive to cheap and we will probably move cheaper until Feb 1st.

Goldman Sachs: Report

Commodities like oil are pricing in the probability of U.S. tariffs once President-elect Donald Trump takes office later on Monday, Goldman Sachs says in an analyst note.

• Oil is pricing in a nearly 40% probability of a 25% US tariff on Canadian goods including oil, which is well above the bank’s in-house view of the odds of such a move by year-end, which are at 15%.

Drawing inventories, strong distillate demand and the latest sanctions impacting Russian oil are supporting energy at present according to Goldman Sachs Co-Head of Commodity Research Samantha Dart.

“The market is repositioning towards these tighter risks, we’ve been trading in this $70-85/bbl Brent range and we think we are going to stay in the range but we see risks skewed to the upside in the near-term,” Dart said.

“There is a direct focus of the market on supply, sanctions get the biggest reaction, the ceasefire if it goes forward, it doesn’t change the supply and demand balance,” Dart said.

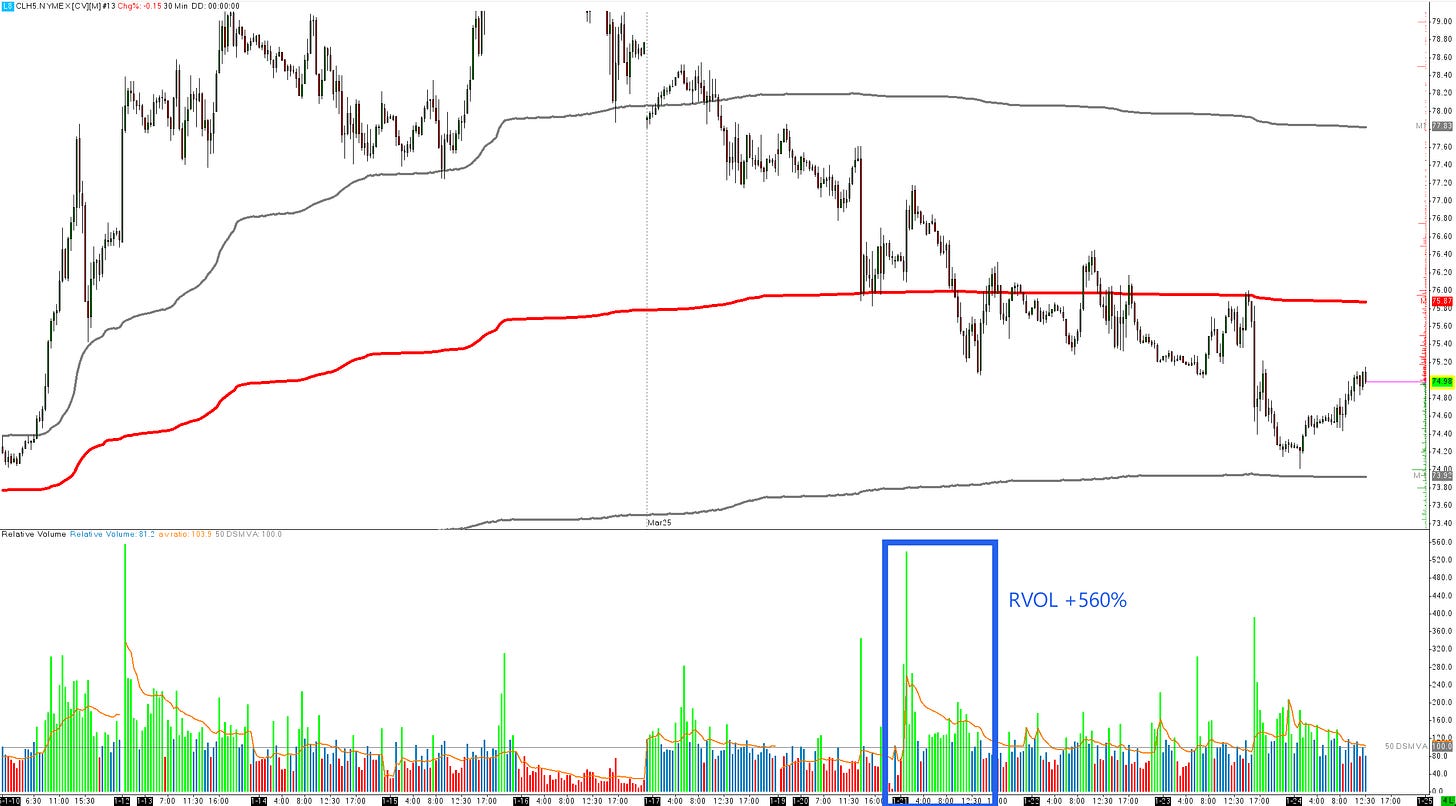

Relative volume on Tuesday around 1am GMT was up 560%. Any dumb money chasing the Trump show only served as liquidity on the offer for larger money to move us down. My thesis is that the main players rotated out of their longs to then buy a deeper pullback to cheaper contextual prices. Read the trade charts at the bottom for more.

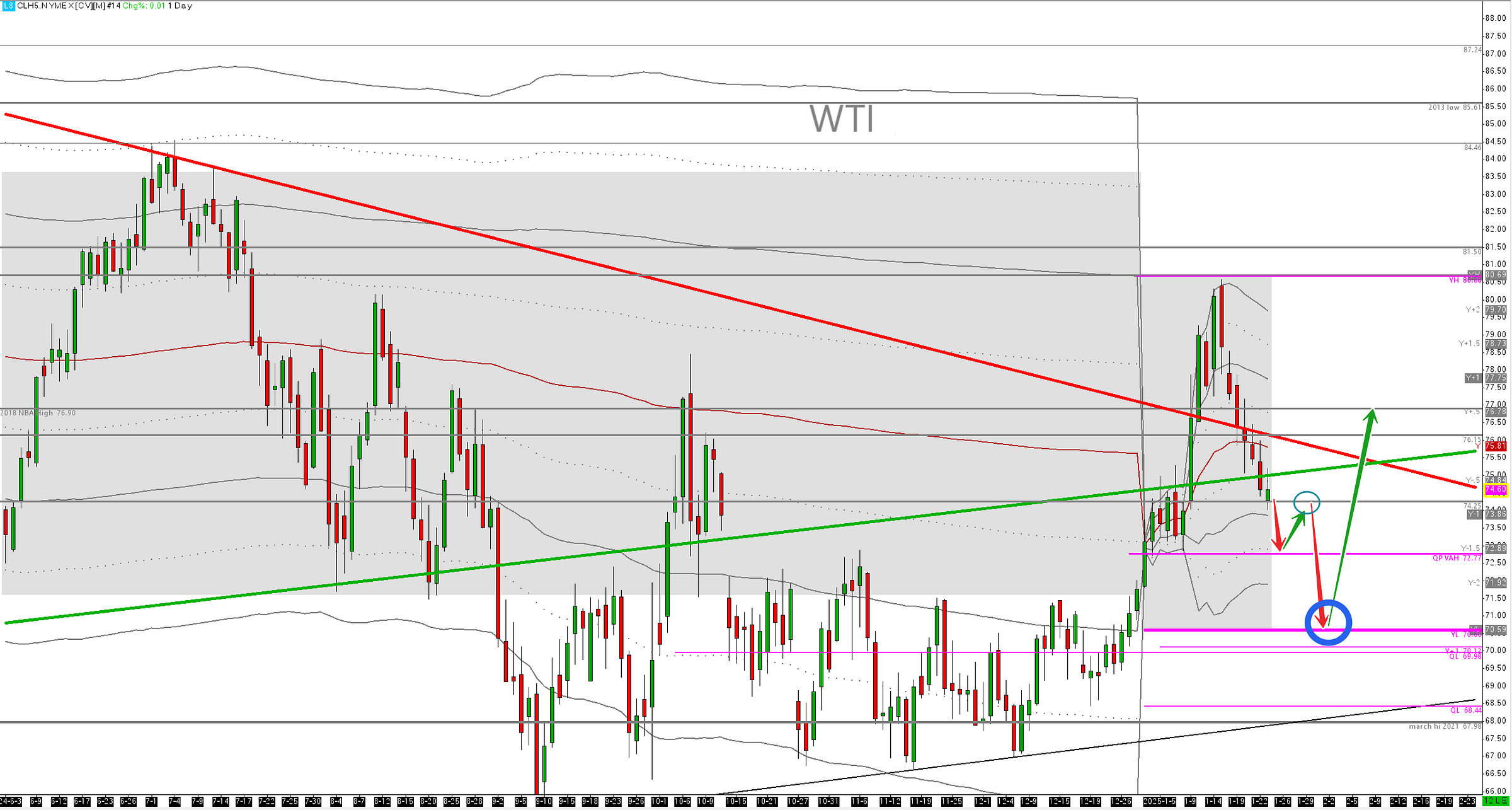

As we were looking for in last weeks report, WTI pulled back to YVWAP/ MVWAP $75.87 (WTI) and below on Friday. The extra downside provided by Trumps Davos address, calling on OPEC to bring down prices. We saw the 2nd largest volumes of the week deployed from this $75.87 area. In the flurry of executive orders and actions, the EV mandate been scrapped would serve thin gruel to any bulls. The net zero/ESG crowd love getting run over.

Tariffs are being used to gain concessions in negotiations, so we must be prepared for some of these to be imposed -which in my view is the largest factor for the next $10 move. Im not really going by any Goldman estimates of what is or is not priced in, Im only looking at what price has done with a combination of differing driver level factors.

There is no use making a threat in negotiations if you are not prepared to go through with it. Should any tariffs be placed on Canadian oil (60% of all imported oil to US), prices would move up, inflicting a harsh dynamic on north American refiners which would be felt almost instantly by US consumers at the pump. Instant inflation on a stick. Central bankers will be watching.

Couple this with a weaker DXY and we have a perfect recipe for WTI $90- $100+. More specifically, we would see the Brent/ WTI spread rise, given the Brent blend is the heavier grade of crude similar to Canadian grade and the only replacement grade.

Also into the risk picture mix is Venezuela. Trump wants to stop all imports from there. Chevron went into Venezuela in 1923 drilling and producing oil. However this year they only plan to drill 30 wells. Where is the oil now? Next door, in Guyana. So it follows that the US administration/ Chevron, no longer cares for Venezuela, which for a long time as been a proxy battlefront between Russia and The US. An entrepreneur could do worse than setting up an ancillary service company/ shop there for the Guyanese coming boom.

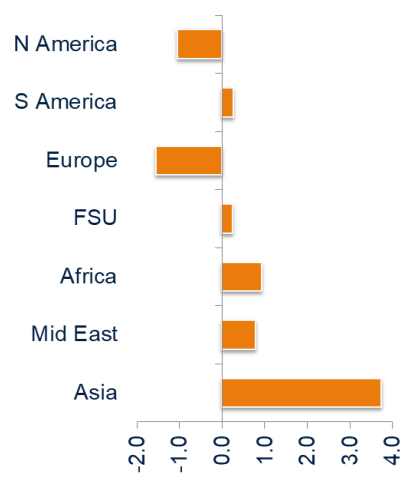

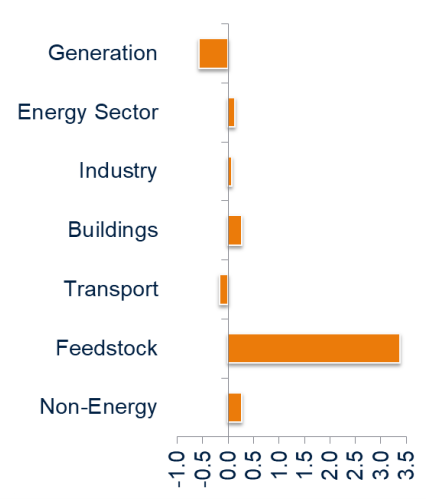

An update on the Chinese demand picture, it has to be understood that while you will see conflicting stories on diminishing demand from China, 'Good demand' (Petrochemical feedstocks) will increase.

Transportation fuel requirements are indeed dropping, however oil demand in China remains strong for chemicals production as highlighted by the Aramco CEO in Davos this week. Video here

Anyways, with the macro covered, lets look at the charts.

WTI CLG5.

In my view, supply has gone from relatively good with waning demand- bearish, to much tighter with Russian tanker sanctions drawing any spare capacity over the last 2 weeks. The pullback we have had this week is simply a repricing and a wait and see within the market. Until we get to Feb 1st, price will hunt lower to start an auction up again from YPVAL.

In Duggan Capital we spot a market dynamic almost everyday called ‘sharking’. Where a market looks to be heading for a large level of concern, it gets extremely close but then doesn't trade. Only to then hunt back down to reload the bus for more traders, then we move back to aforementioned level and not only trade it, but blow straight through it. Price circles like a shark, then destroys.

We DONT go against sharking i.e.. If the price level doesn't trade, volumes dry up below the level, we don't fade it, we look to be part of the reloading of the bus to take it out.

The inverse to sharking is simply a fade. Where we observe the market trade to the price level to the tick or even a little above/below it with intraday momentum. THe faster the move to the level, the better the reversal. This is the type of action where we do fade the level.

Why am I telling you this? Because we sharked the YPVAL (Yearly prior value area high) $80.69 by 10 ticks on the 15th Jan. So in keeping with sharking behaviour, we are monitoring for where we will reload to take this level out. Our likely area is YPVAL (Yearly prior value area low) $70.59. It just so happens to be confluent with M-PVAL $70.53. A good area to see the imbalance up on the month reload buyers and continue the imbalance up.

In the vacuum of Canadian and or Mexican oil tariffs, it is my view we trade down to $70.59/53 area. I am seller of rips before then, not buyer of dips.

Im then looking for buyers to reload the bus, and rally to YPVAH $80.69 and beyond. If Trump lashes on a tariff at the same time, all the better. Then I’m buyer of dips not seller of rips. I just don't see how these tariffs will keep energy prices down.

Okay, that’s all folks. Welcome to a much more volatile market. Jason Shapiro and I have a podcast we launched quietly this year, you can find it here with a new episode coming out Monday discussing Trump and 2025. Jason DOES NOT HOLD BACK.

If you are interested to know more about how I analyse these markets, how my tools work or how the edge works, have a look at the training below. YAou can also checkout The VWAP Report which I also write here

Alpha VWAP Course. 3 months at £275 or £825 one of.

12 Month Alpha Edge Course. 5 days free trial £250 per month or £3000 single payment.

4 Week Alpha Pro Course. 4 Weeks intensive learning.